The CARES Act tax holiday for business aviation was the subject of a recent CNBC segment, which highlighted how travelers can take advantage of these benefits. In addition to breaking down the legislation’s details, the discussion also specifically highlighted how guests can save on federal excise tax with Magellan Jets through the CARES Act. Check out the full video below.

CNBC: CARES Act Tax Holiday for Business Aviation

As CNBC editor Robert Frank notes in the segment, the CARES Act is a “gift that keeps on giving” for private travelers. Passed in March, the legislation suspended the 7.5% federal excise tax on private jet flights through the end of 2020. This includes jet cards, memberships and charter flights purchased before the end of the year, even if you don’t fly until 2021 or beyond.

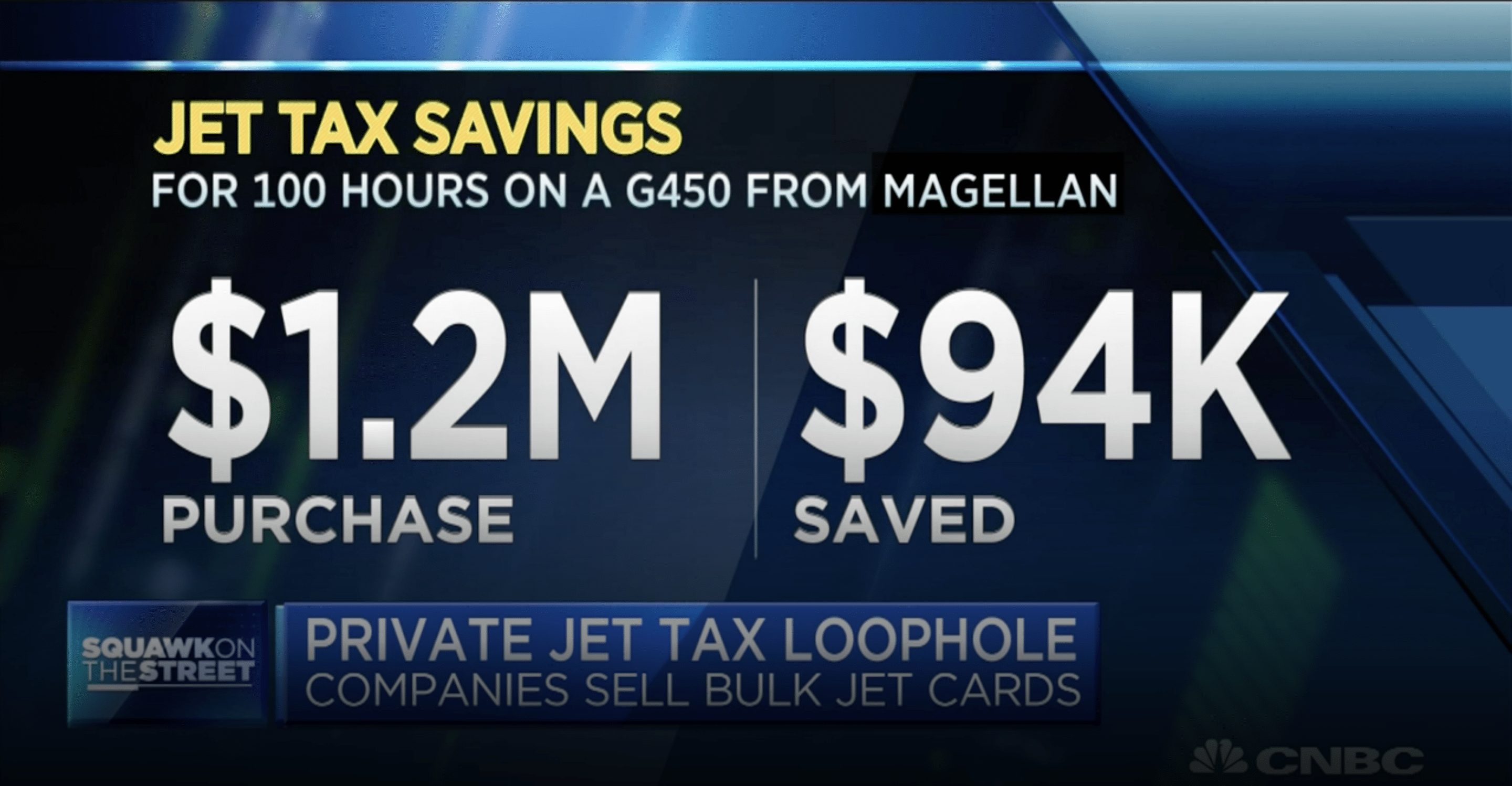

CNBC also highlights how business aviation providers are extending terms, especially when it comes to jet card purchases of 100 hours or more. To illustrate the savings guests can enjoy, Frank showcased how you can save over $94,000 on a Magellan Jets G450 jet card if purchased before the end of the year.

Frank goes on to explain how private jet companies are some of the few in the travel industry to rebound amid the pandemic. “The private jet industry is one of the few travel sectors that actually largely recovered,” says Frank. “With business back to above 80% to where it was pre-COVID.”

Watch the full CNBC clip above, and click the link below to learn more about the CARES Act and private travel.